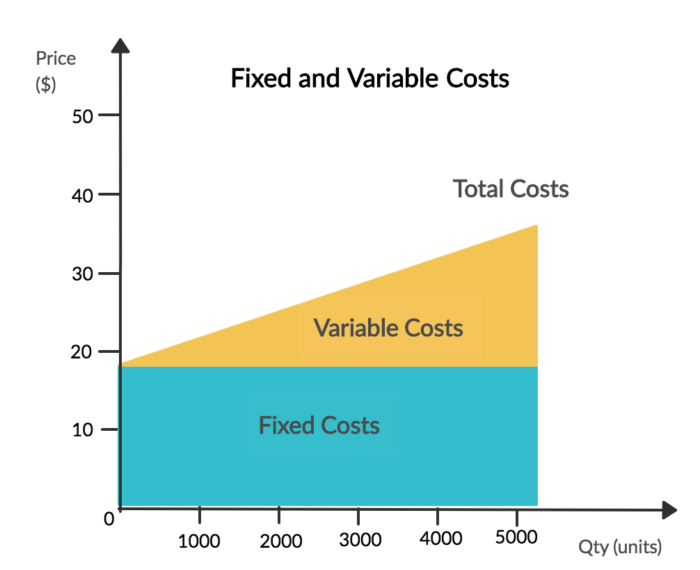

Variable Costs Calculation Formula . It's worth mentioning that firms. The variable cost per unit will vary across profits. Fixed costs are those that will remain constant even when production volume changes. total variable cost = total quantity of output x variable cost per unit of output. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. How to calculate variable costs. table of contents. Classify your costs as either fixed or variable. to determine total variable cost, simply multiply the cost per unit with the number of units produced. Tvc = total quantity of output * vc per unit of output. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. Rent and administrative salaries are examples of fixed costs.

from www.linkscatalog.net

Tvc = total quantity of output * vc per unit of output. total variable cost = total quantity of output x variable cost per unit of output. How to calculate variable costs. It's worth mentioning that firms. The variable cost per unit will vary across profits. table of contents. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. Classify your costs as either fixed or variable. Rent and administrative salaries are examples of fixed costs.

How to calculate the variable cost? Follow these steps Links Catalog

Variable Costs Calculation Formula Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. How to calculate variable costs. table of contents. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. Rent and administrative salaries are examples of fixed costs. to determine total variable cost, simply multiply the cost per unit with the number of units produced. Classify your costs as either fixed or variable. The variable cost per unit will vary across profits. It's worth mentioning that firms. total variable cost = total quantity of output x variable cost per unit of output. Fixed costs are those that will remain constant even when production volume changes. Tvc = total quantity of output * vc per unit of output. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead.

From haipernews.com

How To Calculate Fixed Cost And Variable Costs In Cost Accounting Haiper Variable Costs Calculation Formula It's worth mentioning that firms. The variable cost per unit will vary across profits. Classify your costs as either fixed or variable. Tvc = total quantity of output * vc per unit of output. table of contents. to determine total variable cost, simply multiply the cost per unit with the number of units produced. How to calculate variable. Variable Costs Calculation Formula.

From www.youtube.com

Finding a linear cost function 1 YouTube Variable Costs Calculation Formula [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. The variable cost per unit will vary across profits. table of contents. Rent and administrative salaries are examples of fixed costs. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. Classify. Variable Costs Calculation Formula.

From ondemandint.com

Variable Cost Definition, Examples & Formula Variable Costs Calculation Formula total variable cost = total quantity of output x variable cost per unit of output. to determine total variable cost, simply multiply the cost per unit with the number of units produced. Rent and administrative salaries are examples of fixed costs. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month.. Variable Costs Calculation Formula.

From efinancemanagement.com

Variable Costs and Fixed Costs Variable Costs Calculation Formula table of contents. Fixed costs are those that will remain constant even when production volume changes. It's worth mentioning that firms. Classify your costs as either fixed or variable. How to calculate variable costs. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. [1] whether you produce 1. Variable Costs Calculation Formula.

From study.com

Variable Cost Definition, Formula & Examples Lesson Variable Costs Calculation Formula to determine total variable cost, simply multiply the cost per unit with the number of units produced. The variable cost per unit will vary across profits. How to calculate variable costs. Tvc = total quantity of output * vc per unit of output. table of contents. Variable costing accounting is calculated as the sum of direct labor cost,. Variable Costs Calculation Formula.

From avada.io

How To Calculate Variable Cost? Guide, Examples and Extra Tips Variable Costs Calculation Formula Tvc = total quantity of output * vc per unit of output. It's worth mentioning that firms. table of contents. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. total variable cost = total quantity of output x variable cost per unit of output. The variable cost per unit will. Variable Costs Calculation Formula.

From mailchimp.com

A Guide To Variable Costs Formulas + Tips Mailchimp Variable Costs Calculation Formula Rent and administrative salaries are examples of fixed costs. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. How to calculate variable costs. to determine total variable cost, simply multiply the cost per unit with the number of units produced. The variable cost per unit will vary across. Variable Costs Calculation Formula.

From courses.lumenlearning.com

Using Variable Costing to Make Decisions Accounting for Managers Variable Costs Calculation Formula Tvc = total quantity of output * vc per unit of output. Rent and administrative salaries are examples of fixed costs. Fixed costs are those that will remain constant even when production volume changes. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. [1] whether you produce 1 unit. Variable Costs Calculation Formula.

From blog.golayer.io

How To Find Variable Cost Guide) Layer Blog Variable Costs Calculation Formula to determine total variable cost, simply multiply the cost per unit with the number of units produced. total variable cost = total quantity of output x variable cost per unit of output. table of contents. The variable cost per unit will vary across profits. It's worth mentioning that firms. Rent and administrative salaries are examples of fixed. Variable Costs Calculation Formula.

From www.educba.com

High Low Method Calculate Variable Cost Per Unit and Fixed Cost Variable Costs Calculation Formula How to calculate variable costs. total variable cost = total quantity of output x variable cost per unit of output. to determine total variable cost, simply multiply the cost per unit with the number of units produced. Fixed costs are those that will remain constant even when production volume changes. Rent and administrative salaries are examples of fixed. Variable Costs Calculation Formula.

From www.myaccountingcourse.com

What is Average Variable Cost (AVC)? Definition Meaning Example Variable Costs Calculation Formula Classify your costs as either fixed or variable. Tvc = total quantity of output * vc per unit of output. table of contents. Fixed costs are those that will remain constant even when production volume changes. to determine total variable cost, simply multiply the cost per unit with the number of units produced. Variable costing accounting is calculated. Variable Costs Calculation Formula.

From www.exceldemy.com

How to Calculate Cost per Unit in Excel (With Easy Steps) ExcelDemy Variable Costs Calculation Formula It's worth mentioning that firms. table of contents. How to calculate variable costs. total variable cost = total quantity of output x variable cost per unit of output. Rent and administrative salaries are examples of fixed costs. Fixed costs are those that will remain constant even when production volume changes. Classify your costs as either fixed or variable.. Variable Costs Calculation Formula.

From www.double-entry-bookkeeping.com

How to Calculate Variable Cost per Unit Double Entry Bookkeeping Variable Costs Calculation Formula Tvc = total quantity of output * vc per unit of output. Fixed costs are those that will remain constant even when production volume changes. The variable cost per unit will vary across profits. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. It's worth mentioning that firms. How. Variable Costs Calculation Formula.

From www.youtube.com

How to Calculate Variable Cost Ratio Easy Way YouTube Variable Costs Calculation Formula How to calculate variable costs. to determine total variable cost, simply multiply the cost per unit with the number of units produced. It's worth mentioning that firms. The variable cost per unit will vary across profits. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. Classify your costs. Variable Costs Calculation Formula.

From www.akounto.com

Variable Cost Definition, Formula & Examples Akounto Variable Costs Calculation Formula The variable cost per unit will vary across profits. Classify your costs as either fixed or variable. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. It's worth mentioning that firms. total variable cost = total quantity of output x variable cost per unit of output. table. Variable Costs Calculation Formula.

From www.exceldemy.com

How to Calculate Cost per Unit in Excel (With Easy Steps) ExcelDemy Variable Costs Calculation Formula How to calculate variable costs. [1] whether you produce 1 unit or 10,000, these costs will be about the same each month. It's worth mentioning that firms. The variable cost per unit will vary across profits. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. Classify your costs as. Variable Costs Calculation Formula.

From www.researchgate.net

Mathematical formulas for variable cost calculation (Singh 2017 Variable Costs Calculation Formula to determine total variable cost, simply multiply the cost per unit with the number of units produced. How to calculate variable costs. Rent and administrative salaries are examples of fixed costs. Tvc = total quantity of output * vc per unit of output. table of contents. Fixed costs are those that will remain constant even when production volume. Variable Costs Calculation Formula.

From www.educba.com

Total Cost Formula Calculator (Examples with Excel Template) Variable Costs Calculation Formula total variable cost = total quantity of output x variable cost per unit of output. table of contents. Variable costing accounting is calculated as the sum of direct labor cost, direct raw material cost, and variable manufacturing overhead. Classify your costs as either fixed or variable. Rent and administrative salaries are examples of fixed costs. The variable cost. Variable Costs Calculation Formula.